bubbles sound cuter than they are 🫧

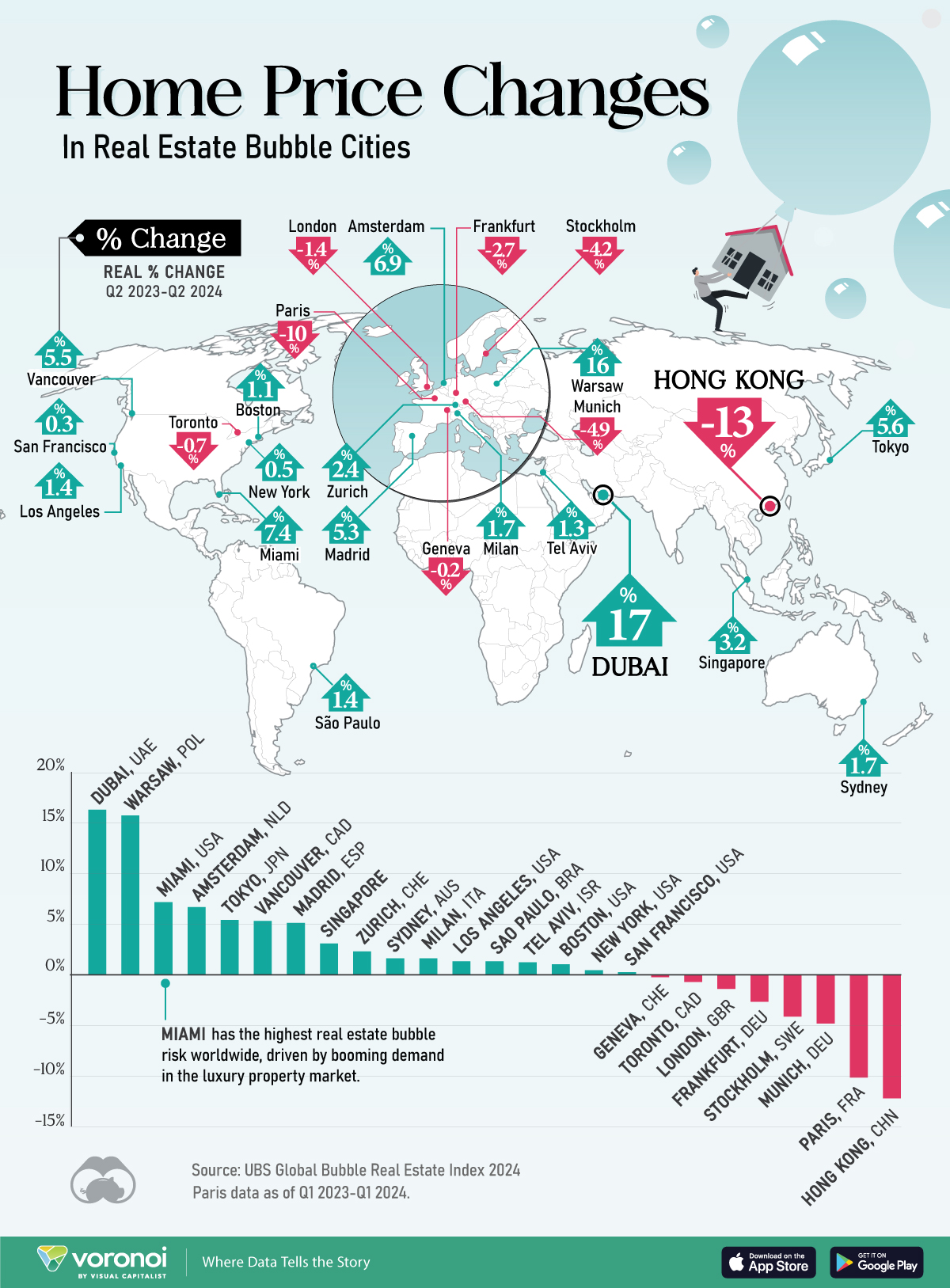

Home Prices Grew The Most In These Real Estate Bubble Cities

Real estate bubbles are steep run-ups in home prices, created by increased demand for housing, limited inventory and risky spending. Eventually, these bubbles burst when demand falls as supply increases.

Using data from the UBS Global Real Estate Bubble Index 2024, Visual Capitalist mapped the change in real home prices across global bubble markets between Q2 2023 and Q2 2024.

Overall, Dubai, UAE, saw the fastest increase in real home prices, with a growth of 16.8 percent over the time period analyzed. Warsaw, Poland, was the only other real estate bubble city to see a double-digit change (16.2 percent).

Of the top 20 bubble markets for real home price growth, five are located in the US: Miami (7.4 percent), Los Angeles (1.4 percent), Boston (1.1 percent), New York (0.5 percent) and San Francisco (0.3 percent).

Click image to enlarge

Found this interesting? Check out the world's least affordable housing markets.

Via Visual Capitalist.