Saving for a comfortable retirement is a priority for most Americans, but with women making just 84 percent of men's average earnings — and living considerably longer, too — the amount both genders need to put away is far from equal.

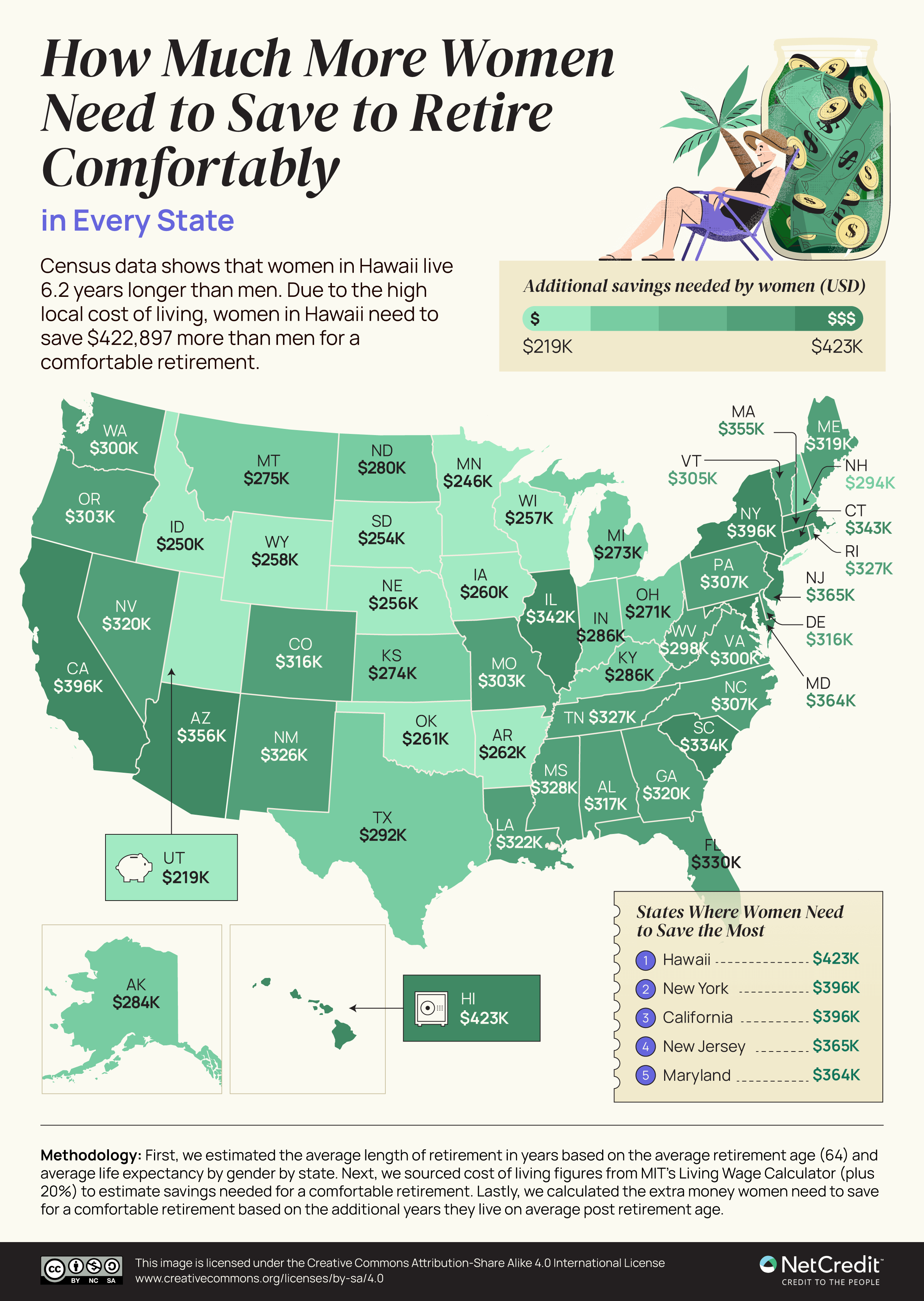

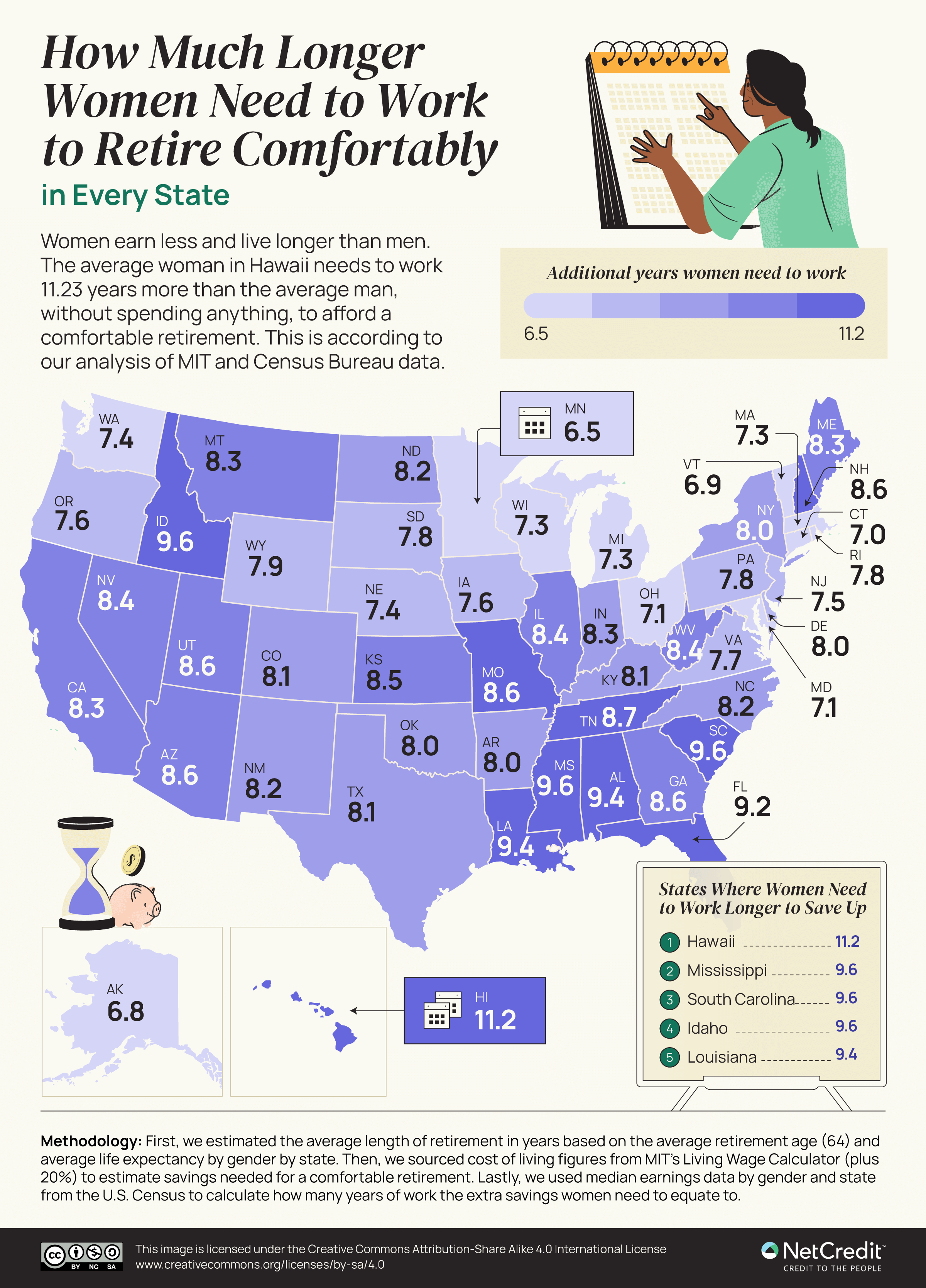

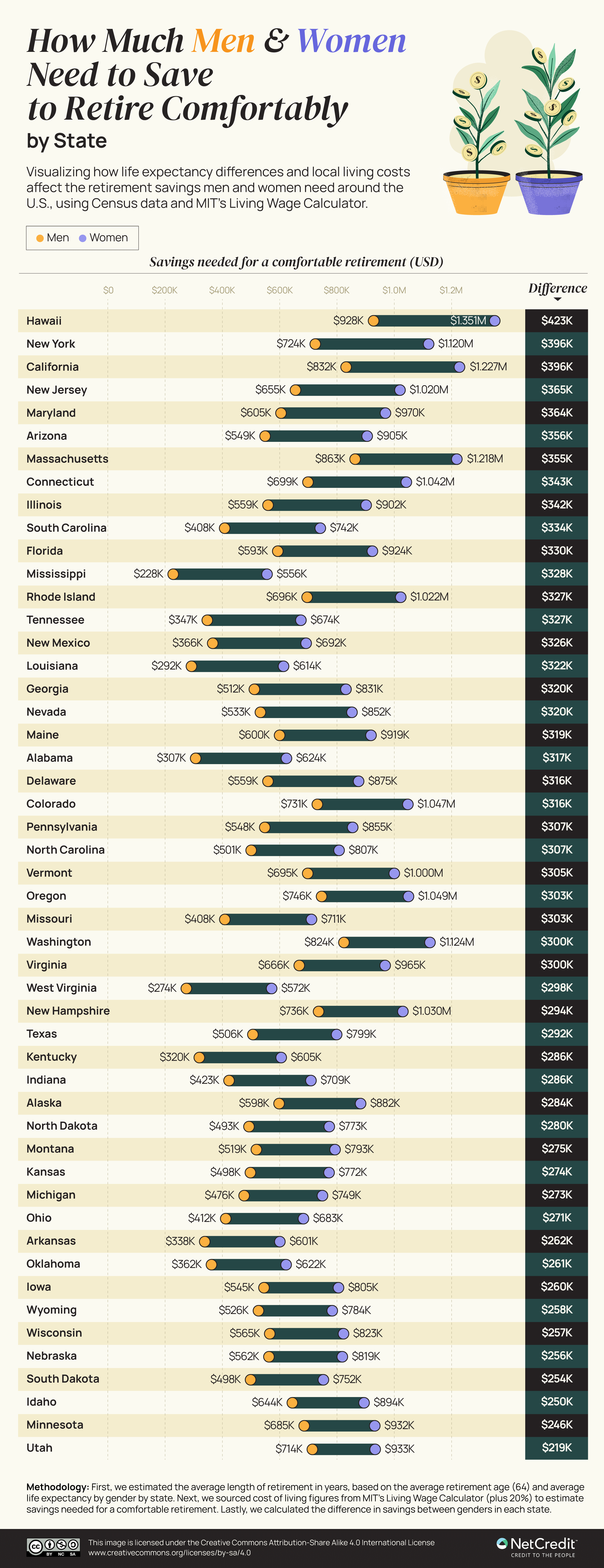

Using data on the average life expectancy, cost of living and earnings in every US state, NetCredit calculated how much more women across America need to save for a comfortable retirement, compared to men. They also worked out how much longer women in each state have to work to achieve their retirement savings goals (assuming they don't spend any money during those extra years).

Women in Hawaii face the largest disparity when it comes to retirement savings, having to put away $422,897 more than men to achieve the $1,350,542 they need to retire comfortably. This inequality is owed to the high average life expectancy of women in Hawaii (19.8 years past retirement age), plus the state's cost of living ($68,209 per year, the highest in the country).

The second-biggest disparity was found in New York, where women need to put aside a total of $1,119,795 for a comfortable retirement — that's $395,616 more than men living in the state, on average.

There are two other states where women have to save at least $365,000 more than men to ensure a comfortable retirement: California ($396,000) and New Jersey ($365,000).

Women in every state have to work several years longer than men to save up for a financially comfortable retirement. Hawaii tops the list, with women needing to work an average of 11.2 additional years, followed by Mississippi (9.6), South Carolina (9.6) and Idaho (9.6).

Click images to enlarge

Via NetCredit.